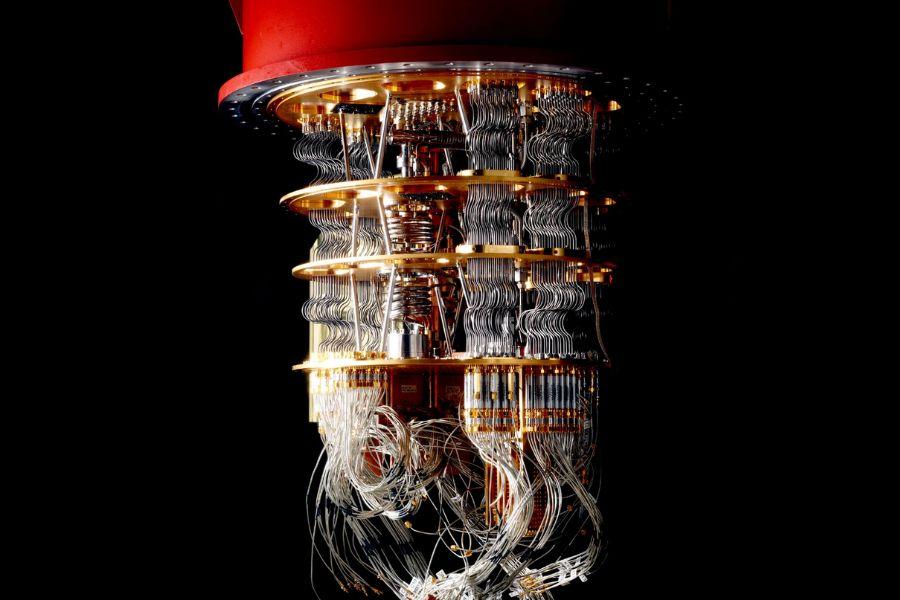

With the introduction of quantum computing, the financial sector is on the verge of a paradigm revolution. This article examines the relationship between quantum computing and banking, emphasizing its revolutionary potential. It also looks at the accessibility of free cloud-based quantum computing software, the value of transaction categorization for financial management, and the vital function quantum computing plays in thwarting fraud.

Impact of Quantum Computing on Finance:

There is great potential for quantum computing to revolutionize finance in a number of important ways. Quantum computers have unmatched processing capacity and are capable of solving challenging optimization issues in risk analysis, asset allocation, and portfolio management. Quantum algorithms can evaluate market trends, forecast asset behavior, and give more precise pricing for derivatives by utilizing sophisticated modeling and simulation capabilities. Quantum computing also makes it possible to optimize portfolios more effectively, enhancing returns and risk control.

Free Cloud-Based Software for Quantum Computing:

The availability of free cloud-based quantum computing software is making accessible quantum computing a reality. Removing the need for costly on-premises infrastructure empowers financial institutions and people. Now, users may practice using quantum computing for financial applications, experiment with quantum algorithms, and learn from their mistakes. Researchers, developers, and financial specialists may work together more easily, which promotes innovation and knowledge sharing in the field of quantum finance.

Transaction Categorization for Financial Management:

Transaction categorization automatically classifies and arranges financial transactions using machine learning algorithms, delivering insightful data. Individuals and corporations can acquire a complete picture of their financial activity by examining their spending habits, income sources, and budgetary allocation. Personalized financial management is made possible by categorizing transactions. Users may then find areas for savings, plan their budgets and investments, and expedite reporting and compliance procedures.

Fraud Prevention and Quantum Computing:

In the fight against fraud in the financial sector, quantum computing’s cutting-edge capabilities are essential. Quantum algorithms are able to identify trends, abnormalities, and potential fraud signs with unmatched accuracy by processing enormous volumes of data in real time. It is possible to create sophisticated fraud detection models that include a large number of variables and interrelated data points. This enables institutions to identify fraudulent activity and take the necessary action quickly. Through sophisticated encryption and authentication techniques, quantum computing also improves security, protecting delicate financial transactions and data.

Conclusion

Due to its unmatched processing and analytical capacity, quantum computing is poised to revolutionize the finance sector. Free cloud-based quantum computing software makes this cutting-edge technology more widely accessible, encouraging creativity and teamwork. Processes for management are streamlined, and financial insights are improved by transaction categorization. Quantum computing, on the other hand, offers a strong defense against fraud, assuring secure transactions and safeguarding both individuals and financial institutions. The use of quantum computing in the financial industry throws up new opportunities for creativity, efficiency, and security.